FAIR THE

FUNDRAISE

100+ investors, one pitchPitching sucks

About

No-Pitch Demo Day is a demo day without the pitching, the accelerator, or the cold outreach. We leverage metrics beyond the pitch and look for investor-directed signals to optimise your time and generate term sheets in a fairer environment.We are the first impact based, blinded, demo day making the fundraising processes fairer for foundersRead more about why we created this and how we've replaced the traditional pitch hereSuccessful applicants will be invited to meet and take questions at the remote demo day with some of the most esteemed VC funds and angels in the UK, Europe and North America.

Demo Days

40 competitive companies talk to hundreds of respected pre-seed and seed investors from their region

W25 Demo Days ScheduleW25 Demo Day UK:

17 February 2024, 2:00 PM GMT

Criteria: UK-based companies actively raising pre-seed or seed rounds.W25 Demo Day USA:

18 February 2024, 2:00 PM EST

Criteria: U.S.-based companies actively raising pre-seed or seed rounds.W25 Demo Day EU:

19 February 2024, 2:00 PM CET

Criteria: Europe-based companies actively raising pre-seed or seed rounds.W25 Demo Day Canada:

19 February 2024, 2:00 PM EST

Criteria: Canada-based companies actively raising pre-seed or seed rounds.General Criteria for All Demo Days:Team Quality: Founders with strong domain expertise and a demonstrated commitment to the problem they are solving.

Market Size: Addressing a large or growing market with significant potential.

Diversity Commitment: Preference for diverse founding teams (gender, ethnicity, background).

Stage of Product: Companies must have a clear value proposition, either with an MVP or in active pilot testing.

Organisers

Investors

Sponsors

Not ready for this demo day? Enter your email below to hear about the next one.

© 2024 No Pitch Demo Day Ltd. All rights reserved.

Thank You

We'll keep you posted with regular updates, deadlines and news

© 2024 No Pitch Demo Day Ltd. All rights reserved.

Our Purpose

Built for Founders by Investors Who Understand the Struggle

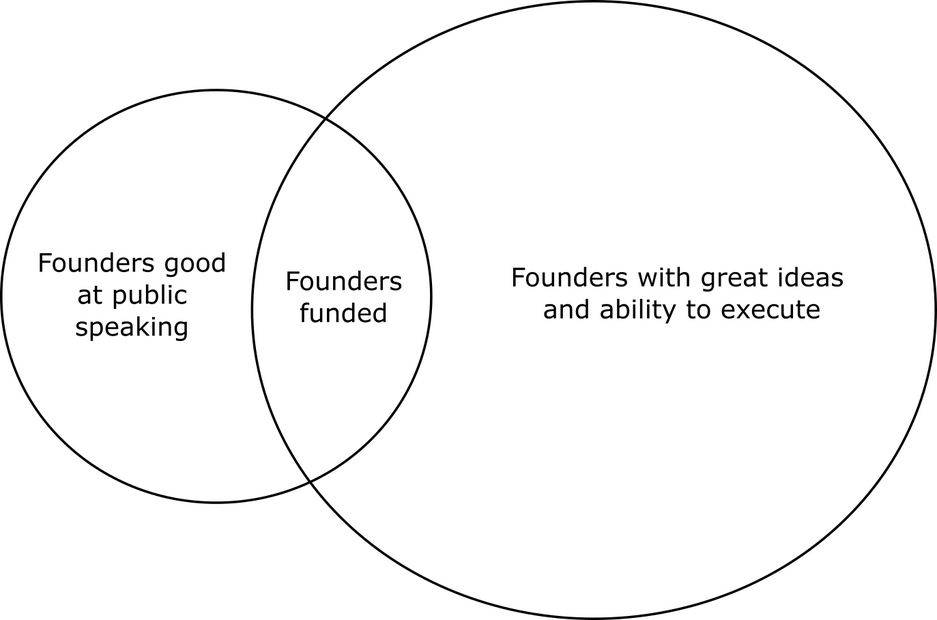

The traditional fundraising process relies heavily on the ability of founders to deliver polished pitches. But we believe there are far more important factors that predict startup success than simply being good at public speaking.Our mission is to eliminate the biases inherent in pitch culture and create a fairer, more data-driven way for startups to connect with investors.Heuristic Biases:Fast decision-making by investors often relies on heuristics—mental shortcuts that can reinforce stereotypes. This contributes to funding disparities across gender, race, and personality types (Kahneman, "Thinking, Fast and Slow"). By eliminating pitch-based decision-making, we aim to reduce the biases that favour specific types of founders.Diversity Gaps:The venture capital industry has historically lacked diversity:

In 2018, less than 1% of VC funding in Europe went to all-female-founded companies (Atomico’s State of European Tech).

Non-white partners make up only 20% of all VC partners in the U.S. (Diversity VC Report).

Of all founders that raised funding in 2019 in Europe, only 0.5% identified as Black (Diversity in Startups Report).The Reality of Pitching:Pitching is stressful, superficial, and often favors those who are charismatic in front of a room. But these qualities do not necessarily predict a founder’s ability to grow a successful company. Our goal is to shift the focus from presentation skills to business fundamentals.

TL;DR Why Is Pitching A Problem?

For Founders

Cold Intros Are Ineffective

Reaching out to investors without connections is often time-consuming and unproductive.

Endless Pitch Deck Revisions Founders spend countless hours perfecting pitch decks, seeking opinions, and spending money on aesthetics, all for a few minutes in front of investors.

Stress and Bias

Pitching is inherently stressful and favors those with natural charisma. This leads to exclusion of highly capable founders who may not "present well."

For VCs and Angels

Relationship Building at High Velocity The rapid pace of today’s fundraising environment makes it hard to form lasting relationships with founders.

Sifting Through Inbound Leads Valuable startups may get lost amidst the noise of numerous incoming pitches.

Lack of Insight Beyond the Pitch Pitching provides a curated snapshot that doesn’t offer insight into the founder’s behavior, decision-making process, or personality—key factors in evaluating long-term potential.

© 2024 No Pitch Demo Day Ltd. All rights reserved.

How No-Pitch Demo Day Works

A Data-Driven Approach to Startup-Investor Connections

Step 1: Application and Investment Memo

Founders submit applications and create investment memos with our team's guidance. We use the Y Combinator investment memo framework and supplement it with additional questions to extract critical information.

Step 2: Shortlisting

A panel of experienced early-stage judges evaluates applications, and the top 50 companies are selected for Demo Day.

Step 3: Investor Access

Fourteen days before Demo Day, investors receive detailed memos of the shortlisted startups, filtered by their sector interests. This allows investors to choose the startups they are most interested in meeting.

Step 4: The No-Pitch Demo Day

On the day of the event, each founder is assigned a virtual room. Investors join their chosen rooms for scheduled meetings to discuss the essential questions about the business. No pitches—just deep, meaningful conversations.

Metrics That Matter

Instead of relying on pitch decks, we provide investors with a thorough understanding of each startup, including:

Founder and Team Fit: Evaluating the alignment between the team and the problem they’re solving.

Traction and Metrics: Growth charts, key revenue drivers, churn rate, customer acquisition costs.

Technology Readiness: Assessment of the product's stage of development.

Business Model and Market Fit: From "business model on a napkin" summaries to impact metrics that define the core value of the startup.

Business Model and Market Fit: From "business model on a napkin" summaries to impact metrics that define the core value of the startup.

The Twitter Pitch: Inspired by Steve Jobs, a concise 140-character summary of the startup’s unique value proposition.

Our approach helps investors quickly uncover the fundamentals and allows founders to demonstrate what truly makes their business unique.

Why Are We Doing This?

Research Supports Data-Driven Approaches

Performance Over Pitching: Studies show that early-stage sales and customer metrics are better indicators of startup success than a well-delivered pitch (Harvard Business Review).

Pitch-Free Funds Have Better Diversity: Funds like Social Capital and Loyal VC, which rely on data-driven evaluations, reported significantly higher representation of women CEOs compared to industry averages.

Bias Reduction: Traditional pitch-based processes often lead to decisions influenced by appearance, charisma, or background. By focusing on data and founder experience, we’re creating a more inclusive environment for those from non-traditional backgrounds or those who may not have access to elite networks.

Problems with Traditional Fundraising

For Founders

Cold Intros Are Ineffective: Reaching out to investors without connections is often time-consuming and unproductive.

Endless Pitch Deck Revisions: Founders spend countless hours perfecting pitch decks, seeking opinions, and spending money on aesthetics, all for a few minutes in front of investors.

Stress and Bias: Pitching is inherently stressful and favors those with natural charisma. This leads to exclusion of highly capable founders who may not "present well."

For VCs and Angels

Relationship Building at High Velocity: The rapid pace of today’s fundraising environment makes it hard to form lasting relationships with founders.

Sifting Through Inbound Leads: Valuable startups may get lost amidst the noise of numerous incoming pitches.

Lack of Insight Beyond the Pitch: Pitching provides a curated snapshot that doesn’t offer insight into the founder’s behavior, decision-making process, or personality—key factors in evaluating long-term potential.

TL;DR – The Problem with Pitching

For Founders:

Time Wasting: Cold intros, warm intros, endless revisions, and the stress of pitching are draining and unproductive.

Inaccessible Skill Set: Not everyone is a natural public speaker or has an existing network.

For Investors:

Superficial Insight: Pitches provide surface-level information that doesn’t always reveal the full picture.

Same Decks, Same Metrics: Investors often see the same curated decks, which may miss the real indicators of success.

Our Solution: We remove the pitch, replace it with real data, and focus on what matters—founder fit, traction, market potential, and more. It’s time to change how startups raise funds and how investors identify opportunities.

Not ready for this Demo Day?

Sign up below to hear about the next one and join us in reshaping the future of fundraising.

© 2024 No Pitch Demo Day Ltd. All rights reserved.

For Founders: A Smarter Way to Fundraise

Why No-Pitch Demo Day is Different for Founders

Raise Capital Without the Stress of Pitching Forget the anxiety of traditional demo days. At No-Pitch Demo Day, there’s no need to deliver a perfect pitch or impress a room full of strangers in a few minutes. Instead, we focus on what really matters—your startup’s true potential.

Get Access to a Network of 100+ Investors Our demo days are attended by hundreds of VCs and angel investors across the UK, Europe, and North America. We connect you with investors who are genuinely interested in your business and align with your sector.

Time-Efficient and Fair Evaluation We understand that time is your most valuable resource. Our evaluation process is data-driven and meritocratic, meaning you get an opportunity to shine based on the strength of your business—not how well you pitch. We ask for your investment memo instead of a pitch deck, and investors dive straight into meaningful questions to understand your growth story.

Benefit from True Diversity of Opportunities Did you know that traditional pitching often leads to funding biases? By focusing on founder fit, traction, and market potential, we level the playing field for all founders, regardless of background, presentation style, or network.

Sign Up Now to Raise Capital Without the Hassle

If you’re ready to redefine the fundraising experience and focus on building relationships, apply to No-Pitch Demo Day and join a community of like-minded, driven founders who are doing the same.

© 2024 No Pitch Demo Day Ltd. All rights reserved.

For VCs and Angels: Quality Deal Flow Without The Noise

Why No-Pitch Demo Day is Essential for Investors

Focus on Metrics That Matter We know your time is precious. Traditional demo days can feel like watching the same pitch again and again. No-Pitch Demo Day takes a different approach—we focus on what’s important: performance, traction, and real data. You receive a curated set of investment memos from our top 50 companies, providing in-depth insights before you even meet the founders.

Skip the Pitch, Get to the Point Founders are assigned virtual rooms where you can join at scheduled times and get straight to the vital questions. Skip the polished scripts and see how founders respond to real challenges. Our process is designed to give you deeper insights into the team's mindset, problem-solving abilities, and market understanding.

More Inclusive and Impactful Investments Traditional pitch formats often reinforce biases that leave behind promising founders from underrepresented groups. By focusing on data-driven evaluations, we’ve seen a 35% increase in funding for underrepresented founders. Your participation in NPDD not only helps you find the best opportunities but also supports a more diverse and dynamic startup ecosystem.

Join a Global Community of Investors Participate alongside 100+ leading investors, including major VC funds and angel investors from across the UK, Europe, and North America. Build relationships and collaborate to make impactful investments that go beyond the pitch.

Ready to Discover High-Quality Opportunities?

Sign up to register as an investor and join the next No-Pitch Demo Day to experience a more efficient and impactful way to invest in startups.

For SPV: Invest Together in the Future of Startups

What is an SPV (Special Purpose Vehicle) and Why You Should Join

Invest Alongside Leading VC Funds: At No-Pitch Demo Day, we provide a way for individual investors to participate in high-potential startup funding rounds through our Special Purpose Vehicle (SPV). Even if you're not a multi-millionaire, you can co-invest with top-tier venture capital funds like Lightspeed, GV, and others.

Accessible, Flexible Investment Opportunities: SPVs allow you to invest with a minimum of just £1,000, making high-potential startup investing accessible to more individuals. You don’t have to worry about navigating the complexities of venture investing on your own; our SPVs make it simple to get involved.

Stringent Selection for Better Outcomes: We create SPVs for companies that have already been vetted and selected as Demo Day finalists. Plus, we only raise SPVs for companies that already have a top VC fund leading their investment round. This ensures that the startups you invest in have been through multiple levels of due diligence, reducing your risk.

Transparent and Investor-Friendly Terms: Our SPV terms are designed with transparency and fairness in mind:

Fees and Carry: We charge a fair fee structure with a 3.95% management fee and 15% carry. This aligns our incentives with yours—our team succeeds only when your investments perform.

Ongoing Updates: As an SPV participant, you receive semi-annual updates on the progress of the companies in which you invest, keeping you informed of commercial highlights and growth milestones.

Your Opportunity to Be Part of the Future

By joining our SPVs, you can be part of the next big thing in startups—invest alongside top VCs, access high-quality opportunities, and contribute to making venture funding fairer and more inclusive.

Sponsorship: Empowering Startups to Succeed

Why Sponsor No-Pitch Demo Day?

No-Pitch Demo Day is about creating equal opportunities for all startups to access funding, regardless of their background or network. Sponsoring NPDD gives you the chance to be part of this movement and help build a more inclusive and diverse startup ecosystem.

Directly Sponsor Startup Participation: When investors sign up for NPDD, they do more than just gain access to high-quality deal flow—they actively sponsor a place for a startup. This helps reduce financial barriers for early-stage founders and allows them to get the exposure they need to grow. By sponsoring a startup's participation, you are investing not only in a company but in the next generation of entrepreneurship.

Make an Impact Beyond the Pitch Traditional funding processes often leave behind startups that don’t have the right connections or can't afford the cost of participation. Your sponsorship helps ensure that all deserving founders have the opportunity to be evaluated based on merit, not on their ability to pay for access or pitch perfectly. You play a direct role in democratising startup funding and supporting diverse founders.

Gain Visibility as a Sponsor: Sponsors receive prominent visibility throughout our Demo Day events, with branding opportunities across our virtual platform and marketing materials. Showcase your commitment to empowering innovation and making startup funding more accessible.

Types of Sponsorship Opportunities

Individual Investor Sponsorships: Every investor who signs up to participate also contributes to sponsoring a startup space, giving them a chance to connect with leading investors and demonstrate their growth potential.

Corporate Sponsorships: Corporations and larger investors can purchase multiple spaces to support even more startups, gaining added recognition throughout the event.

Nominate a Startup: Sponsors can nominate startups they believe deserve a place at NPDD, providing an opportunity for founders within their network to gain invaluable exposure.

Sponsorship Benefits

Visibility and Brand Recognition: Gain exposure to a network of founders, investors, and industry leaders as a supporter of inclusive entrepreneurship.

Positive Impact on the Startup Ecosystem: Actively contribute to reducing biases in venture funding and promoting a fairer evaluation process.

Exclusive Access to Reports: Sponsors receive our special industry report, providing valuable insights on emerging trends, founder performance, and more.

Invest in the Future—Sponsor a Startup Today

Your support could be the key difference in a startup’s journey. By sponsoring a space, you empower founders to gain the visibility they need and help create a more equitable startup environment for all.

© 2024 No Pitch Demo Day Ltd. All rights reserved.